Trump Aligns With Dockworkers as Tariffs Scare The Trucking Industry

Blog Post CTA

Dockworkers have a formidable ally in their contract standoff with their East and Gulf Coast ports. Donald Trump reiterated his position in their fight against automation with the United States Maritime Alliance (USMX), sparking questions about whether there will be another Biden-esque intervention when the temporary contract expires on Jan. 15, 2025.

As the president-elect prepares to take office, he has made many

proposals about tariffs and continues to show willingness to use them as a weapon in the current trade war with various countries. If the tariffs backfire, industries like trucking and manufacturing will be impacted, with businesses across several verticals bracing for impact.

Questions loom over the future of the U.S. Postal Service (USPS) as it continues to struggle. Even Donald Trump is considering privatization of the company. We have this and more news, trends, and updates from around the freight world. Keep reading to find out more.

Trump Voices Support for Dockworkers' Union on Automation Issues

President-elect Donald Trump has reiterated his opposition to automation in shipping operations while strongly supporting the International Longshoremen's Association (ILA) in its contract dispute with employers at East and Gulf Coast container ports. After meeting with ILA leaders Dennis and Harold Dagget at his Mar-a-Lago residence, the soon-to-be president shared a message affirming his recognition of the union's work. This dispute centers on the ILA's opposition to automated cranes, which they argue threaten jobs and port security.

At the same time, the United States Maritime Alliance (USMX) contends such technology is vital if the country and its ports hope to compete on the global stage. As it stands now, none of the ports in the U.S. rank within the top 50 most efficient ports of the world, with most of the blame resting on their refusal to move ahead with automation. With contract talks stalled and the current agreement set to expire on Jan. 15, the prospect of a strike looms. However, this is not unfamiliar territory as previous disruptions, such as a three-day strike in October, halted operations and required federal intervention.

Employers have warned clients to brace for potential service interruptions, while shippers have preemptively managed cargo flows.

Despite the president-elect's support of the union workers, his approach to handling a prolonged strike remains unclear. As seen in previous labor disputes, the federal government could invoke the Taft-Hartley Act to intervene. The stakes remain high for workers seeking job security and the industry vying for modernization.

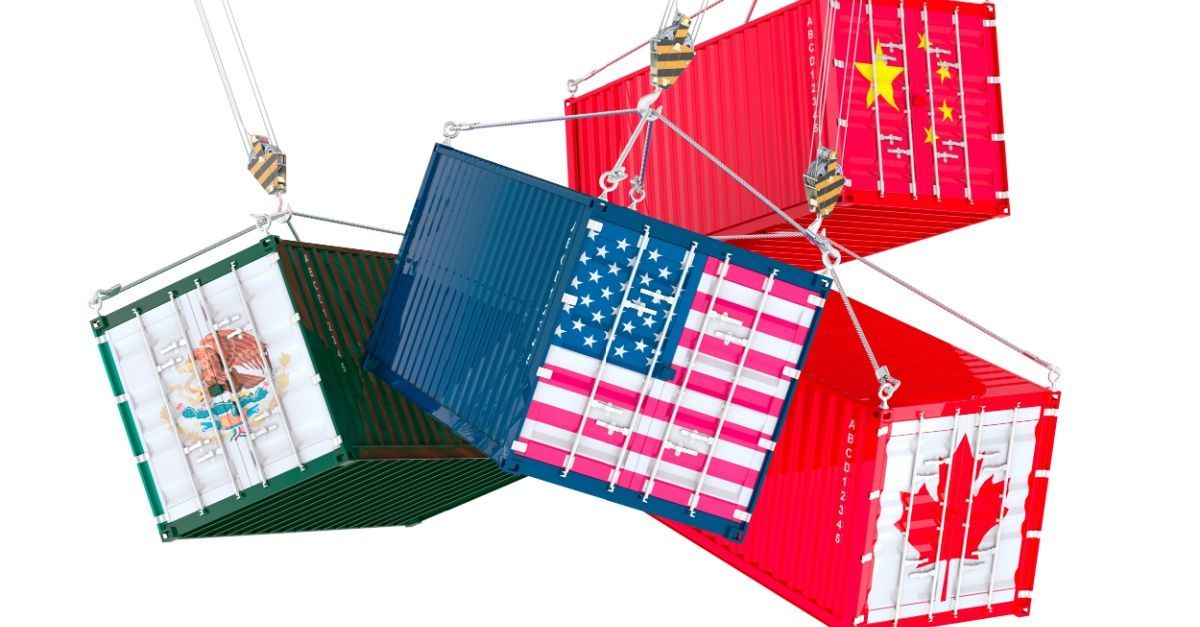

Trucking Industry Braces for Impact of Tariff Policies Under Trump

Donald Trump has proposed tariffs on imports, including a potential 60% rate on goods from China and 25% tariffs across North America. All of which are raising concerns within the trucking industry. Most people and businesses within the industry understand that these measures may be used as leverage in trade negotiations. Still, they are also expected to influence freight demand and consumer costs.

Economists and industry experts warn that tariffs could slow economic activity, potentially offsetting the benefits of extended tax cuts. The trucking sector, which heavily relies on freight from North American manufacturing hubs, is

particularly sensitive to changes in trade policy.

Although the full extent and timing of these tariffs remain uncertain, the trucking industry is preparing for potential disruptions in the movement of goods. Analysts predict a modest improvement in trucking conditions in 2025, though substantial growth is unlikely. As the administration moves forward, businesses and policymakers will closely monitor the balance between trade barriers and economic growth.

Trump Considers Privatization of U.S. Postal Service Amid Financial Losses

President-elect Donald Trump has reportedly discussed the potential privatization of the U.S. Postal Service (USPS) with key transition officials, including Commerce Secretary nominee Howard Lutnick. Citing USPS's $9.5 billion loss in the past financial year, Trump has questioned the need for government subsidies for the struggling agency.

The USPS has faced challenges from declining mail volumes and slower-than-expected growth in parcel shipping. During Trump's first term, his appointment of Louis DeJoy as Postmaster General sparked debate due to cost-cutting measures that were criticized for causing service delays. Details of how Trump might pursue privatization or reforms for the USPS remain unclear.

Truckload Spot Rates Reach Two-Year High Amid Tightening Capacity

The National Truckload Index (NTI) has climbed to $2.52 per mile, marking the highest level since January 2023. Despite a year-over-year decline in dry van outbound tender volumes, tender rejection rates have increased, reaching their highest point since July. These trends suggest tightening capacity drives rate increases, even with reduced overall demand.

The number of active trucking authorities has dropped by 4% compared to December 2023, reflecting fewer carriers in the market. This shrinking capacity could pose challenges for shippers, especially if demand surges in 2025 due to economic stimulus or policy changes. Industry experts recommend that shippers secure contract rates to ensure capacity availability, as future volume spikes might lead to higher rates and reduced options.

Supreme Court to Review Biofuel Producers' Challenge to California Emission Rules

The U.S. Supreme Court has agreed to hear a case concerning California's vehicle emission regulations. The hearing aims to address climate change by setting limits on auto pollution. Companies, including Valero Energy Corp. units involved in biofuel production and sales, argue that the Environmental Protection Agency overstepped its authority by allowing California to enforce these standards.

The outcome of this case could have broad implications for state-level environmental policies, particularly as the recent election of Donald Trump raises questions about the future of such regulations.

OnTrac and GLS US Announce Shipping Rate Increases for 2025

Parcel carriers OnTrac and GLS US are set to raise shipping rates in the coming weeks. Starting January 1, 2025, OnTrac’s rates will increase by an average of 5.7%, along with surcharges for residential, oversized, and rural deliveries. GLS US will implement a 5.9% average rate increase on December 23, 2024, near the end of the peak holiday shipping period, and will also adjust its surcharges.

OnTrac, which has expanded aggressively despite recent volume declines and rising costs, offers shippers long-term rate agreements and incentives. GLS US continues to expand its domestic and international reach, recently introducing direct delivery services between the U.S. and Europe and forming partnerships with other carriers to strengthen its network.

These increases are slightly below those announced by FedEx and UPS for the same period.

Dollar General Expands Leadership Team Amid Competitive Challenges

Dollar General has named Kevin Pinchon as Senior Vice President of Distribution and Tom Hutchins as Senior Vice President of Technology. Pinchon, who joined in June, manages distribution strategies across several states, drawing on experience from HD Supply and Target. Hutchins, onboard since September, oversees IT operations, having previously held leadership roles at Tractor Supply Company and Office Depot.

These appointments are part of a broader leadership expansion, including ten promotions and another new hire across various departments. Dollar General's management highlighted the contributions these leaders are expected to bring in efficiency, service improvements, and technology integration.

The retailer faces inflation, stiff competition from other low-cost chains, and shrinking operating profits. Dollar General plans to open 800 new stores in 2024, maintaining its growth strategy while navigating an increasingly harsh economic environment.

Navigate Truck Rates and Financials with Entourage Freight Solutions

Trucking rates are at historic lows. While this can seem like good news for shippers looking to contract their freight or ship it via the spot market, it also means the market is somewhat unstable, and trucking carriers will do what they can to recoup costs and stay afloat.

Shippers need access to freight management services and real-time data to keep up with their shipments and stabilize operations in a volatile environment.

Entourage Freight Solutions provides steady services to help you navigate an ever-changing logistics environment and receive important information in real time.

Entourage Freight Solutions offers the following services and many more:

- Our LTL Service provides on-demand access to capacity, real-time data, and peace of mind in this high-stakes world.

- Our Freight Management lets your team stay organized across inbound and outbound logistics, tracking market capacity and using automation notifications to keep everyone informed.

- Our Refrigerated Transport provides expertise in everything from finished goods to raw materials, ensuring products arrive on time and in top condition.

Request a quote today to see how Entourage Freight Solutions can help with your freight movement and other supply chain needs.